Build Your Own AI Investor With Machine Learning and Python Step by Step 1st Edition by Damon Lee PhD ISBN 1838132201 9781838132200

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Build Your Own AI Investor With Machine Learning and Python Step by Step 1st Edition by Damon Lee PhD – Ebook PDF Instant Download/Delivery: 1838132201, 9781838132200

Full download Build Your Own AI Investor With Machine Learning and Python Step by Step 1st Edition after payment

Product details:

ISBN 10: 1838132201

ISBN 13: 9781838132200

Author: Damon Lee PhD

Build Your Own AI Investor

Breaks down Value Investing for the AI revolution, whilst being accessible to anyone, even if you’ve never invested in stocks or coded before

Teaches Python step-by-step, from installation and the basics, all the way to creating your own AI Investor that picks stocks for you

Watch the AI Portfolio: See AI portfolio performance over time on the website, made with the code in this book.

AI Investing

Not sure how to approach the stock investing with AI?

No time to learn these programming skills? Think it sounds daunting?

Think the investing game is rigged by computer-wielding financial wizards?

Do It All Yourself

Discover Value Investing, the approach taken by the best investors: Warren Buffett, Joel Greenblatt, Michael Burry, Peter Lynch, John Templeton, Charlie Munger

Build your own AI! Have your own Value Investing machine provide stock picks for the year

No time? Set up the AI in a weekend by skipping ahead to Chapter 5

Anyone can learn the computing tools, every step is in this book to build a value investing AI

Your AI Investor in action

Make it personal, make your Robo-Investor as conservative or aggressive as you desire

Watch how your AI would pick stocks over the last 10 years with backtesting, test your AI as thoroughly as you like

Open source tools: All programming tools are available online for free. Working code from the book is available online for readers. Train your AI using free online historical stock market data. (For present day stock selection you will need a SimFin+ online subscription, no affiliation.)

For beginners, exercises are provided in every chapter to develop your Python skills, slowly building competence until you can use Machine Learning tools for general problems.

For advanced readers this books provides a good basis in value investing, framing the stock selection problem in a quantitative way, using Machine Learning algorithms on stock market data.

This is NOT financial advice. This is an educational book teaching data analysis tools for financial information.

Read less

Build Your Own AI Investor With Machine Learning and Python Step by Step 1st Table of contents:

Chapter 1: Introduction to AI Investing

- 1.1 What is AI in Investing?

- 1.2 The Evolution of Algorithmic and Quantitative Trading

- 1.3 Key Concepts in Machine Learning

- 1.4 Overview of Investment Strategies (e.g., Value, Growth, Momentum)

Chapter 2: Setting Up Your Development Environment

- 2.1 Installing Python and Required Libraries

- 2.2 Introduction to Jupyter Notebooks for Data Science

- 2.3 Setting Up Git for Version Control

- 2.4 Overview of Required Python Libraries (Pandas, NumPy, Scikit-learn, etc.)

- 2.5 Introduction to Data Sources for Financial Data (Yahoo Finance, Alpha Vantage)

Chapter 3: Understanding the Financial Markets and Data

- 3.1 The Basics of Stock Market Data

- 3.2 Key Financial Indicators (Price, Volume, PE Ratio, etc.)

- 3.3 Types of Data: Historical, Real-Time, and Alternative Data

- 3.4 Data Preprocessing and Cleaning for Financial Data

- 3.5 Handling Missing Data and Outliers

Chapter 4: Machine Learning Algorithms for Financial Predictions

- 4.1 Overview of Machine Learning Techniques (Supervised vs. Unsupervised Learning)

- 4.2 Regression Models for Predicting Stock Prices

- 4.3 Classification Models for Predicting Market Movements (Buy/Sell)

- 4.4 Time Series Forecasting Models (ARIMA, LSTM)

- 4.5 Model Evaluation Metrics (RMSE, Accuracy, F1-Score)

Chapter 5: Building Your First Prediction Model

- 5.1 Loading and Exploring Financial Data in Python

- 5.2 Feature Engineering for Stock Price Prediction

- 5.3 Implementing a Simple Linear Regression Model

- 5.4 Testing and Evaluating Your First Model

- 5.5 Tuning Hyperparameters for Improved Performance

Chapter 6: Enhancing the AI Investor with Advanced Machine Learning Models

- 6.1 Introduction to Decision Trees and Random Forests

- 6.2 Support Vector Machines (SVM) for Market Prediction

- 6.3 Neural Networks for Deep Learning in Finance

- 6.4 Implementing Recurrent Neural Networks (RNN) and LSTMs

- 6.5 Hyperparameter Optimization and Cross-Validation

Chapter 7: Backtesting and Simulation

- 7.1 What is Backtesting and Why Is It Important?

- 7.2 Setting Up a Backtesting Framework in Python

- 7.3 Evaluating Portfolio Performance (Sharpe Ratio, Max Drawdown, etc.)

- 7.4 Using Historical Data to Test Your AI Investor Strategy

- 7.5 Simulating Real-World Trading Scenarios

Chapter 8: Risk Management and Portfolio Optimization

- 8.1 Introduction to Risk Management in Trading

- 8.2 The Modern Portfolio Theory (MPT)

- 8.3 Implementing Portfolio Optimization with Python (Efficient Frontier)

- 8.4 Value at Risk (VaR) and Other Risk Metrics

- 8.5 Dynamic Portfolio Rebalancing with Machine Learning

Chapter 9: Deploying Your AI Investor

- 9.1 Deploying Your Model to Make Real-Time Predictions

- 9.2 Building a Trading Bot to Execute Trades Automatically

- 9.3 Using APIs to Connect to Stock Exchanges (Interactive Brokers, Alpaca)

- 9.4 Monitoring Performance and Updating Models

- 9.5 Ethical Considerations in AI Trading

Chapter 10: Going Further with AI in Finance

- 10.1 Exploring Alternative Data (Sentiment Analysis, Social Media)

- 10.2 Reinforcement Learning for Trading Strategies

- 10.3 Future Trends in AI and Machine Learning in Finance

- 10.4 Learning Resources for Further Study

People also search for Build Your Own AI Investor With Machine Learning and Python Step by Step 1st:

build your own ai investor damon lee

build your own ai investor

damon lee ai investor

damon investor

damon williams investor

Tags:

Damon Lee PhD,AI Investor,Machine,Python

You may also like…

Computers - Programming

Computers - Computers - General & Miscellaneous

Computers - Computer Science

Housekeeping & Leisure - Modelmaking

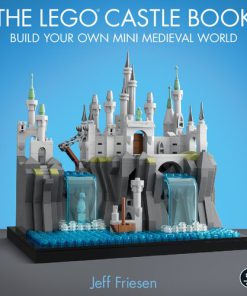

The LEGO Castle Book Build Your Own Mini Medieval World 1st Edition Jeff Friesen

Children's Books - Computers & Technology

Create Computer Games Design and Build Your Own Game Patrick Mccabe

Computers - Computer Science

Build Your Own Redis with C C 1st edition by James Smith ISBN 8372815469 9788372815469

Computers - Computer Science

Build Your Own Database From Scratch James Smith 9798391723394