Portfolio Construction Measurement and Efficiency Essays in Honor of Jack Treynor 1st Edition by John B Guerard ISBN 3319816454 978-3319816456

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Portfolio Construction, Measurement, and Efficiency: Essays in Honor of Jack Treynor 1st Edition by John B. Guerard – Ebook PDF Instant Download/Delivery: 3319816454, 978-3319816456

Full download Portfolio Construction, Measurement, and Efficiency: Essays in Honor of Jack Treynor after payment

Product details:

ISBN 10: 3319816454

ISBN 13: 978-3319816456

Author: John B. Guerard

This volume, inspired by and dedicated to the work of pioneering investment analyst, Jack Treynor, addresses the issues of portfolio risk and return and how investment portfolios are measured. In a career spanning over fifty years, the primary questions addressed by Jack Treynor were: Is there an observable risk-return trade-off? How can stock selection models be integrated with risk models to enhance client returns? Do managed portfolios earn positive, and statistically significant, excess returns and can mutual fund managers time the market?

Since the publication of a pair of seminal Harvard Business Review articles in the mid-1960’s, Jack Treynor has developed thinking that has greatly influenced security selection, portfolio construction and measurement, and market efficiency. Key publications addressed such topics as the Capital Asset Pricing Model and stock selection modeling and integration with risk models. Treynor also served as editor of the Financial Analysts Journal, through which he wrote many columns across a wide spectrum of topics.

This volume showcases original essays by leading researchers and practitioners exploring the topics that have interested Treynor while applying the most current methodologies. Such topics include the origins of portfolio theory, market timing, and portfolio construction in equity markets. The result not only reinforces Treynor’s lasting contributions to the field but suggests new areas for research and analysis.

Table of contents:

-

The Theory of Risk Return and Performance Measurement

-

Origins: Markowitz and CAPM Based Selection

-

Market Timing

-

Returns, Risk, Portfolio Selection and Evaluation

-

Validating Return-Generating Models

-

Invisible Costs and Profitability

-

Mean-ETL Portfolio Construction in US Equity Market

-

Statistical Issues and Methods for Improvement

-

The Duality of Value and Mean Reversion

-

Performance of Earnings Yield and Momentum Factors in US and International Equity Markets

-

Alpha Construction in a Consistent Investment Process

-

Empirical Analysis of Market Connectedness as a Risk Factor for Explaining Expected Stock Returns

-

Measurement When Fundamentals Are Observable

-

Constructing Mean-Variance Efficient Frontiers Using Foreign Large Blend Mutual Funds

-

Evaluating DFA, WisdomTree, and RAFI PowerShares

-

Time-Series and Cross-Sectional Analysis versus Constant Elasticity of Variance (CEV) Model

-

The Losers and the Winners

-

Leveling the Playing Field

-

The Investment Performance of Contrarian Funds

People also search for:

portfolio construction is about combining

portfolio construction with hierarchical momentum

portfolio construction with climate risk measures

portfolio construction with python

portfolio construction with qualitative forecasts

Tags: John B Guerard, Portfolio Construction, Measurement and Efficiency, Essays in Honor of Jack Treynor

You may also like…

Politics & Philosophy

Instruments & Measurements

Politics & Philosophy

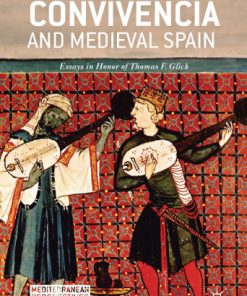

History - World History

Convivencia and Medieval Spain: Essays in Honor of Thomas F. Glick Mark T Abate

Politics & Philosophy - Anthropology

Psychology - Social Psychology

Business & Economics - Management & Leadership

Business & Economics - Management & Leadership

Quantitative Corporate Finance 2nd Edition John B. Guerard Jr.

Cookbooks