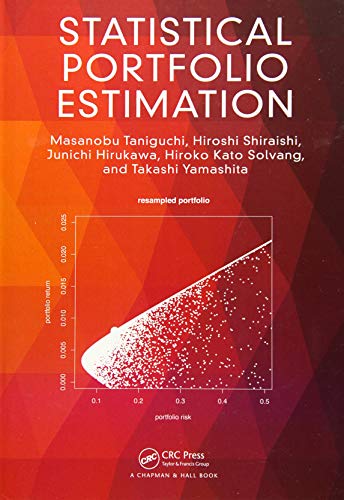

Statistical Portfolio Estimation 1st Edition by Masanobu Taniguchi, Hiroshi Shiraishi, Junichi Hirukawa, Hiroko Kato Solvang, Takashi Yamashita ISBN 1351643622 9781351643627

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Statistical Portfolio Estimation 1st Edition by Masanobu Taniguchi, Hiroshi Shiraishi, Junichi Hirukawa, Hiroko Kato Solvang, Takashi Yamashita – Ebook PDF Instant Download/Delivery: 1351643622, 978-1351643627

Full download Statistical Portfolio Estimation 1st Edition after payment

Product details:

ISBN 10: 1351643622

ISBN 13: 978-

Author: Masanobu Taniguchi, Hiroshi Shiraishi, Junichi Hirukawa, Hiroko Kato Solvang, Takashi Yamashita

The composition of portfolios is one of the most fundamental and important methods in financial engineering, used to control the risk of investments. This book provides a comprehensive overview of statistical inference for portfolios and their various applications. A variety of asset processes are introduced, including non-Gaussian stationary processes, nonlinear processes, non-stationary processes, and the book provides a framework for statistical inference using local asymptotic normality (LAN). The approach is generalized for portfolio estimation, so that many important problems can be covered.

This book can primarily be used as a reference by researchers from statistics, mathematics, finance, econometrics, and genomics. It can also be used as a textbook by senior undergraduate and graduate students in these fields.

Statistical Portfolio Estimation 1st Table of contents:

1. Introduction

2. Preliminaries

2.1 Stochastic Processes and Limit Theorems

3. Portfolio Theory for Dependent Return Processes

3.1 Introduction to Portfolio Theory

3.1.1 Mean-variance Portfolio

3.1.2 Capital Asset Pricing Model

3.1.3 Arbitrage Pricing Theory

3.1.4 Expected Utility Theory

3.1.5 Alternative Risk Measures

3.1.6 Copulas and Dependence

3.1.7 Bibliographic Notes

3.1.8 Appendix

3.2 Statistical Estimation for Portfolios

3.2.1 Traditional Mean-variance Portfolio Estimators

3.2.2 Pessimistic Portfolio

3.2.3 Shrinkage Estimators

3.2.4 Bayesian Estimation

3.2.5 Factor Models

3.2.5.1 Static Factor Models

3.2.5.2 Dynamic Factor Models

3.2.6 High Dimensional Problems

3.2.6.1 The Case of

3.2.6.2 The Case of

3.2.7 Bibliographic Notes

3.2.8 Appendix

3.3 Simulation Results

3.3.1 Quasi-Maximum Likelihood Estimator

3.3.2 Efficient Frontier

3.3.3 Difference Between the True Point and the Estimated Point

3.3.4 Inference of μp

3.3.5 Inference of Coefficient

3.3.6 Bibliographic Notes

4. Multiperiod Problem for Portfolio Theory

4.1 Discrete Time Problem

4.1.1 Optimal Portfolio Weights

4.1.2 Consumption Investment

4.1.3 Simulation Approach for VAR(l) Model

4.1.4 Bibliographic Notes

4.2 Continuous Time Problem

4.2.1 Optimal Consumption and Portfolio Weights

4.2.2 Estimation

4.2.2.1 Generalized Method of Moments (GMM)

4.2.2.2 Threshold Estimation Method

4.2.3 Bibliographic Notes

4.3 Universal Portfolio

4.3.1 μ-Weighted Universal Portfolios

4.3.2 Universal Portfolios with Side Information

4.3.3 Successive Constant Rebalanced Portfolios

4.3.4 Universal Portfolios with Transaction Costs

4.3.5 Bibliographic Notes

4.3.6 Appendix

5. Portfolio Estimation Based on Rank Statistics

5.1 Introduction to Rank-Based Statistics

5.1.1 History of Ranks

5.1.1.1 Wilcoxon’s Signed Rank and Rank Sum Tests

5.1.1.2 Hodges-Lehmann and Chernoff-Savage

5.1.2 Maximal Invariants

5.1.2.1 Invariance of Sample Space, Parameter Space, and Tests

5.1.2.2 Most Powerful Invariant Test

5.1.3 Efficiency of Rank-Based Statistics

5.1.3.1 Least Favourable Density and Most Powerful Test

5.1.3.2 Asymptotically Most Powerful Rank Test

5.1.4 U-Statistics for Stationary Processes

5.2 Semiparametrically Efficient Estimation in Time Series

5.2.1 Introduction to Rank-Based Theory in Time Series

5.2.1.1 Testing for Randomness Against ARMA Alternatives

5.2.1.2 Testing an ARMA Model Against Other ARMA Alternatives

5.2.2 Tangent Space

5.2.3 Introduction to Semiparametric Asymptotic Optimal Theory

5.2.4 Semiparametrically Efficient Estimation in Time Series and Multivariate Cases

5.2.4.1 Rank-Based Optimal Influence Functions (Univariate Case)

5.2.4.2 Rank-Based Optimal Estimation for Elliptical Residuals

5.3 Asymptotic Theory of Rank Order Statistics for ARCH Residual Empirical Processes

5.4 Independent Component Analysis

5.4.1 Introduction to Independent Component Analysis

5.4.1.1 ICA Model for Financial Time Series

5.4.1.2 ICA Modeling in Frequency Domain for Time Series

5.5 Rank-Based Optimal Portfolio Estimation

5.5.1 Portfolio Estimation Based on Ranks for Independent Components

5.5.2 Portfolio Estimation Based on Ranks for Elliptical Residuals

6. Portfolio Estimation Influenced by Non-Gaussian Innovations and Exogenous Variables

6.1 Robust Portfolio Estimation under Skew-Normal Return Processes

6.2 Portfolio Estimators Depending on Higher-Order Cumulant Spectra

6.3 Portfolio Estimation under the Utility Function Depending on Exogenous Variables

6.4 Multi-Step Ahead Portfolio Estimation

6.5 Causality Analysis

6.6 Classification by Quantile Regression

6.7 Portfolio Estimation under Causal Variables

7. Numerical Examples

7.1 Real Data Analysis for Portfolio Estimation

7.1.1 Introduction

7.1.2 Data

7.1.3 Method

7.1.3.1 Model Selection

7.1.3.2 Confidence Region

7.1.3.3 Locally Stationary Estimation

7.1.4 Results and Discussion

7.1.5 Conclusions

7.1.6 Bibliographic Notes

7.2 Application for Pension Investment

7.2.1 Introduction

7.2.2 Data

7.2.3 Method

7.2.4 Results and Discussion

7.2.5 Conclusions

7.3 Microarray Analysis Using Rank Order Statistics for ARCH Residual

7.3.1 Introduction

7.3.2 Data

7.3.3 Method

7.3.3.1 Rank Order Statistic for ARCH Residual Empirical Process

7.3.3.2 Two-Group Comparison for Microarray Data

7.3.3.3 GO Analysis

7.3.3.4 Pathway Analysis

7.3.4 Simulation Study

7.3.5 Results and Discussion

7.3.5.1 Simulation Data

7.3.5.2 Affy947 Expression Dataset

7.3.6 Conclusions

7.4 Portfolio Estimation for Spectral Density of Categorical Time Series Data

7.4.1 Introduction

7.4.2 Method

7.4.2.1 Spectral Envelope

7.4.2.2 Diversification Analysis

7.4.2.3 SpecEnv to the Mean-Diversification Efficient Frontier

7.4.3 Data

7.4.3.1 Simulation Data

7.4.3.2 DNA Sequence Data

7.4.4 Results and Discussion

7.4.4.1 Simulation Study

7.4.4.2 DNA Sequence for the BNRFl Genes

7.4.5 Conclusions

7.5 Application to Real-Value Time Series Data for Corticomuscular Functional Coupling for SpecEnv and the Portfolio Study

7.5.1 Introduction

7.5.2 Method

7.5.3 Results and Discussion

8. Theoretical Foundations and Technicalities

8.1 Limit Theorems for Stochastic Processes

8.2 Statistical Asymptotic Theory

8.3 Statistical Optimal Theory

8.4 Statistical Model Selection

8.5 Efficient Estimation for Portfolios

8.5.1 Traditional Mean Variance Portfolio Estimators

8.5.2 Efficient Mean Variance Portfolio Estimators

8.5.3 Appendix

8.6 Shrinkage Estimation

8.7 Shrinkage Interpolation for Stationary Processes

People also search for Statistical Portfolio Estimation 1st:

statistics portfolio examples

portfolio analysis statistics

bayes-stein estimation for portfolio analysis

d statistics population genetics

f-statistic p-value interpretation

Tags:

Masanobu Taniguchi,Hiroshi Shiraishi,Junichi Hirukawa,Hiroko Kato Solvang,Takashi Yamashita,Statistical,Portfolio,Estimation 1st

You may also like…

Computers - Applications & Software

Software Estimation Without Guessing 1st Edition by George Dinwiddie ISBN 1680506986 978-1680506983

Computers - Computer Science

Online Portfolio Selection Principles and Algorithms 1st Edition Bin Li (Author)

Business & Economics - Personal Finance

Portfolio management theory and practice Second Edition. Edition Heisler

Business & Economics - Personal Finance

Behavioral Finance and Your Portfolio 1st Edition Michael M Pompian